Long boom, long bust? Why business could get brutal

I experienced my first recession as an adult back in the early 1990s. It wasn’t pleasant, but it gave me some perspective so I have a pretty pragmatic view about the …

I experienced my first recession as an adult back in the early 1990s. It wasn’t pleasant, but it gave me some perspective so I have a pretty pragmatic view about the current economic cycle.

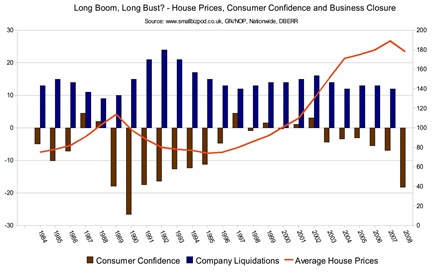

Whether or not things are slowing down or heading towards the dreaded ‘R’ word, it’s a good time to be making business contingencies. Particularly if the following chart is any indication of how things might turn out [click chart below to see full size version].

I’ve always wondered how the housing market, consumer confidence and business success or failure interact. The chart collated by SmallBizPod brings all that together from well respected, long established data sources (Gfk/NOP, Nationwide, DBERR). It’s a simplified perspective, but it’s interesting nonetheless.

What’s striking is how similar the pattern today looks compared to the pattern in the late 80s and early 90s. Consumer confidence (brown bars on the chart) peaks just before house prices (red line), when people start to get nervous. Average house prices fall, consumer confidence plummets and a year later businesses start going down the pan (blue bars). The time frames are longer this time around and house prices have risen much higher, but the basic pattern is beginning to look familiar.

The old cycles of boom and bust were much criticised. But the late 1980s boom was quite short as was the bust that followed it. The question now is whether rather than disappearing the cycle has just become extended.

If so, things could well become pretty brutal for a lot of small businesses out there over the next few years.

I spoke to Stephen Alambritis, head of press at the Federation of Small Businesses (FSB) earlier today and asked him how his members are reading the situation.

According to a recent spot poll of 9,000 FSB members, 80% say they will not be expanding over the next 12 months and 40% fear they will have to lay off jobs. As Alambritis says:

It’s a very pessimistic outlook. It’s going to be a rough year and not much better in 2009. But our members say they’ve been putting money away over the last few years, having learned from the recession of the early 1990s, so they’re not going to need to go to banks to borrow to survive.

Chinwag’s recent Digital Pulse survey shows a similar slide in confidence within the UK’s digital industry. Then there’s all the other economic bad news with which we’re becoming familiar.

I don’t believe in talking up recession. I do believe in taking a cold-eyed business view of the situation and making decisions on that basis. You’ve got to mix a touch of pragmatism in with your entrepreneurial bravado sometimes.

Meanwhile, I just hope my crystal ball gazing proves flawed and statistics turn out to be lies. It’ll bring me great pleasure to be wrong.

Leave a comment

Share & Comment

Related Posts

SME News

- Entrepreneurs 2012 with President Bill Clinton 13-16 November

- IDCEE 2012. Internet Technologies and Innovations

- Nurturing the next generation of social entrepreneurs

- Get Britain Trading needs you

- Manufacturing gains, but economy fragile

- Minister to answer webcast questions on apprenticeships

- Staff beat £230 million a day cost of big freeze

SME Blog

SME Blog

9 comments

9 comments

There’s an up-side. Recessions help entrepreneurs to innovate. These things come in cycles – there’s even a theory by Kondratiev (worth a look in Wikipedia) that states that the cycles usually last about 50 years. Innovators use the enabling technologies of the previous boom to create the next one. Booms times can make us lazy!

Well this is to be expected when we have an economy that’s built purely on inflated house prices. “No more boom and bust” said Brown.

At least it’s not bad news for everyone. Some first time buyers might have a chance getting on the property ladder in the next two to three years as prices fall.

And at least we’ll stop hearing Terry and Joanne talking about how they’ve “made five grand on their property in the last six months.” 🙂

Agree with Dave above. I was reading in Money Week this week that the dotcom bust caused people to stop, rethink and innovate new technologies such as broadband which helped stimulate the healthy internet we have today.

The article’s argument was the same thing will happen with energy given the current oil bubble we’re going through.

I really hope so as it’s killing me at the pumps.

@Dave great point. I’ll check out the Kondratiev article. Lack of cash in the market may well lead to innovative approaches and test the resourcefulness of entrepreneurs. It’s still going to be mighty tough for businesses that want to grow fast.

@Stephen The economy’s not purely built on inflated house prices. It’s built on a significant shift in people’s and banks’ attitudes to debt.

Power cells/batteries is where we really want innovation. Anyone who can invest a battery that can power my laptop for 12 hours and my electric car for the same period of time is going to be a billionaire. Wish I understood why this technology appears to be so hard to progress. Or maybe it’s the oil companies hindering progress?

Insightful article, Alex.

On a related note, I think we’re in for a bit of a dot com bust. It’s just not sustainable to have all these Web 2.0 companies with an “advertising” business model. As soon as the economy goes soft, advertising money will dry up or at least slow down, and those hopeful businesses just will have to find some other way of making money. So I think we’re in for a shakeout — but it will be good because there are just too many players in the Web 2.0 space. There’s always a silver lining to any black cloud.

Anita

Thanks Anita. I’m sure there will be a Web 2.0 shakeout. It’ll be a lot less painful than the original dot.com crash, I reckon. Lots of mini-bubbles bursting and a few bruised egos. The ‘relative’ low cost of entry means I don’t think as many people will lose their shirts this time around.

Alex, You asked in your message via Facebook whether I was running a business during that last downturn. How could you ask! I was just a boy back then!

That said we did buy our first house back in Sept 90, paid our first mortgage payment at the heady interest rate of 15.95% and saw 30% fall off the value of our home over the following three years. Aside from that it didn’t affect me! Funny thing is we bought the house for that old fashioned reason: somewhere to live, rather than as something I expected to double my money on.

But to sail both counter to and with the wind:

As you know we sell into the retail sector. Sales for Jan-Jun 08 and up 6% on 07. A good performance. But Raw material and transport costs have gone through the roof and the weedy pound has hurt because we have significant euro purhcases and few euro sales. So I should probably be worried.

But I am optimistic. We have increased our marketing spend to stimulate demand and keep market share strong. That way if 09 is bloody (and I think it is 09 that will hold the hardest yards) but we maintain or improve market share, grit our teeth and keep our heads we should arrive the other side of the storm in a strong poistion to succeed as the economy turns up again.

We have the best team we have ever had on the pitch at the just the right time, and a brand which had zero value in 05 yet is now 20% of our business and has real international potential.

I’ll keep you posted, but I don’t intend to be on the casualty list.

Thanks Clive – I remember the heady days of the early 1990s when the flat I owned was in £40k negative equity for years and we only bought it for £70k! In comments elsewhere I’ve said the British haven’t redefined their relationships with their homes/houses since Thatcher introduced ‘right to buy’. But that a whole other kettle …

Always good to hear your perspective from the front line. I don’t for a minute believe you guys will be casualties. You’ve got your heads screwed on the right way around. Nevertheless, Blitz spirit required, I think!

Hi Alex. Interesting graph – not a set of figures I’ve seen together before. The effect of inflation hasn’t been stripped out, hence exaggerating the recent rise, but I guess the shape of the curve would be similar. Wage inflation is the index house prices should increase in line with – in an ideal world of course!

Unfortunately I think we’re heading for a longer downturn than the early 90’s as consumers now have such high levels of debt. Only quick fix to that would be rampant inflation and that wouldn’t be great for business either!

Keep up the good work with the podcasts – particularly enjoyed the interview with Clive B, who I notice has commented here – thanks Clive!

Hi Jon, thanks for the comment. The house price figures from Nationwide are what Nationwide calls ‘real house prices’ i.e. they are adjusted for RPI. I take your point about wage inflation. I think I’ve seen that mapped against house prices before and of course it shows a chasm between pay and house price rises.

Glad you’re enjoying the podcasts – do spread the word!